– I’ve said before that there’s another big shoe waiting to drop. Â

– I’ve said before that there’s another big shoe waiting to drop. Â

– One has to smile thinking about the folks in Washington, D.C. thinking that if they can just get the bail-out monies distributed correctly that it will light a fire and the U.S. economy will roar back to life.  Maybe, but the world is bigger than just what’s happening in the U.S. Capital.

– We owe China a huge sum of money and no one has made a convincing case, that I’ve seen, that there’s a pathway open before us via which the U.S. becomes a net generator of wealth again.  Rather, on the path we’re on, we will very likely continue to increase our foreign debt as we essentially ‘kite’ our checks by selling enough U.S. bonds this year to pay off our debt obligations from last year and have a bit left over to spend on pretending that we’re solvent.  Next year?  Repeat the same formula.

– This isn’t fooling anyone overseas.  But, the only reason they keep buying our bonds is to avoid the near-term pain if they stop and we’re forced to default on our debt either through simply not paying it or by cranking up the money printing presses and printing off enough to pay them. Of course, printing money won’t really be paying them – because printing money we don’t really have will vastly devalue it and what they get in real value will be far less than what they are owed.

– But, the Chinese, among others, are not stupid.  They see the traps inherent in avoiding the short-term pain today and deferring the problem into a bigger and more profound long-term pain later.  Â

– I think the article, below, is about China beginning to ‘face up’ to the problem they have with so much of their trade surplus money being invested in a country (the U.S.) that is showing, more and more, that it simply doesn’t have and won’t have the ability to pay its debts back.Â

– There’s another side to this as well. Â China is, on the surface, a Capitalist powerhouse. Â But, let’s not forget that it is also still a communist dictatorship run by the same folks who have had it as their central aim for many decades to remake the world in the image they want and to help China ascend to the dominate position in that new world.

– Calculations are being made, I am sure, in China about how much damage they will sustain and how much we in the U.S. will sustain, if they simply stop buying our bonds and treasuries and let our economy crumble.  It won’t be pretty, everyone knows.  But, if at the end of it, China, with it’s huge cash reserves (even after it loses what it’s invested with the U.S., is still half way solvent and the U.S.,on the other hand, has transitioned from the sole world super-power into something far less – much as Britain went from an empire the sun never set on to a bunch of feisty folks on an island just west of mainland Europe, then China will have won the long term battle for dominance.

– I’m not saying it will turn out that way.  There are a lot of other big cards on the table and it is impossible to know how they will play out. Â

- Can China remain internally stable if the world goes through a major shakeup (vastly bigger than what we’re seeing now)?

- Can the economic furnaces of the world ever really be restarted given that they only seem to be able to run on a model predicated on ever continuing growth and consumption in a world that grows smaller and more finite by the day?

- Can any of this play out without being strongly overridden and washed out by the Global Climate Changes that we’ve already put into motion?

It may be that this squabble for world dominance between China and the U.S. is nothing more that a game of shuffleboard that everyone’s focused on – but that the game itself is being held on the Titanic and the date is April 14th, 1912.

= = = = = = = = = = = = =Â * * * = = = = = = = = = = = = =

By Jason Simpkins

Managing Editor

Money Morning

Finance officials from Beijing in Moscow on Thursday held a videoconference to discuss the creation of a “supra-national reserve currency,” the latest evidence of the support China is getting from developing countries as it seeks to replace the U.S. dollar as the world’s main reserve currency.

This controversial proposal – and the support that it’s getting – also underscores China’s continued emergence as a growing global force in both the financial and political arenas. That’s a trend that successful global investors won’t be able to ignore.

The recent torrent of criticism to swirl around the dollar began with remarks by Chinese Premier Wen Jiabao. Speaking last month at a press conference leading up to the recent Group 20 meeting in London, Premier Wen voiced his concern about the value of China’s large holdings of U.S. Treasuries.

“We have lent a huge amount of money to the United States,” he said. “Of course, we are concerned about the safety of our assets. To be honest, I am definitely a little bit worried. I request the U.S. to maintain its good credit, to honor its promises and to guarantee the safety of China’s assets.”

Of China’s $2 trillion in foreign currency holdings, about $1 trillion is invested in U.S. Treasuries and notes issued by other government affiliated agencies, such as Fannie Mae (FNM) and Freddie Mac (FRE).

“They are worried about forever-rising deficits, which may devalue Treasuries by pushing interest rates higher,” JP Morgan & Co. (JPM) analyst Frank Gong told The Associated Press. “Inside China, there has been a lot of debate about whether they should continue to buy Treasuries.”

Earlier this year, the Congressional Budget Office (CBO) projected that the U.S. budget deficit would nearly triple from last year’s $455 billion – and would reach a staggering $1.2 trillion. And that was even before U.S. President Barack Obama unveiled his $787 billion in stimulus, bank-rescue and anti-foreclosure plans. And that massive projected shortfall also doesn’t include other fix-up initiatives that are sure to surface in the months ahead.

More… ➡

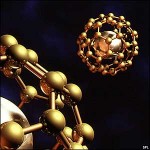

– I’ve been concerned about nanotechnology for sometime (

– I’ve been concerned about nanotechnology for sometime (